Look who’s decided they want to be the next Ramit Sethi. You, with your half-baked dreams of finance blogging riches and early retirement. Don’t worry, we’ve all been there. Thinking we can just waltz onto the internet and start doling out financial advice like we’re qualified.

But here’s a little insider info: the finance blogging game is not for the faint of heart. With heavy hitters like Budgets Are Sexy and The Simple Dollar dominating the niche, you’ve got your work cut out for you. But if you’re willing to grind and find that tiny sliver of the pie that’s still up for grabs, you might just make it. Let’s see if you have what it takes, shall we?

Why Finance Is One of the Top Niches for Blogging

Everyone Loves Money

Let’s face it, money makes the world go round. Whether you’ve got stacks of cash or are scraping by paycheck to paycheck, thoughts of money consume us. That’s what makes finance such a popular blogging niche. Readers are endlessly fascinated by how to earn more, spend less, and make the money they have work for them.

An Ever-Changing Landscape

The world of finance is always evolving. Tax laws change, new financial tools emerge, and economic ups and downs impact our wallets. Readers keep coming back to finance blogs to stay on top of the latest tips and hacks for navigating an ever-shifting financial landscape. As a blogger, you’ll never run out of new topics to cover.

Low Barrier to Entry

You don’t need a PhD in economics to start a finance blog. If you have a basic grasp of finance concepts and can explain ideas clearly, you’ve got what it takes. The niche also lends itself well to tutorials, stories, product reviews, and other easy-to-produce content types.

While the finance niche is competitive, don’t let that stop you. With a unique perspective, consistent high-quality content, and by covering the latest trends, your finance blog can rise above the noise. Money makes people talk, so give them something to talk about! The opportunities in this niche are as endless as people’s appetite for accumulating more wealth.

My Top Pick: Budgeting and Money Management

Listen, we get it. Budgeting isn’t exactly thrilling Friday night fare. But if you want to get your finances in order and maybe even retire someday, a budget is non-negotiable. The good news is, it doesn’t have to be as painful as a root canal without novocaine.

Make a Game of It

Gamify your budget to make it more fun. Give yourself rewards when you meet savings goals or stay within budget for the month. A little positive reinforcement can go a long way.

You can also use budgeting apps that turn the process into an actual game, with quests, levels, and badges to unlock. If an app isn’t your thing, create your own scorecard or progress chart. Turn budgeting into a challenge instead of a chore.

Automate as Much as Possible

Have your paycheck directly deposited and set up automatic bill pay for utilities, insurance, loan payments, and other recurring costs. Automating the boring stuff leaves you free to focus on irregular expenses and your financial goals. Out of sight, out of mind.

Review and Revise

Once you have a budget in place, actually use the darn thing. Track your income and spending for a few months to make sure your budget is realistic. Make adjustments as needed to account for unexpected costs or changes in income or expenses.

A budget is a living document, not written in stone. Review it regularly and roll with the punches. If you stay on top of it, you’ll be rewarded with financial peace of mind and stability. How’s that for motivation?

01. Investing Blog

So, you want to start an investing blog, do you? Look at you, all ambitious and optimistic. Before you dive in headfirst, let me give you the cold, hard truth about this niche. Everyone and their mother wants to be the next Warren Buffett.

The competition is fierce, and the chances of you providing some unique insight are slim to none. But don’t despair just yet, you naïve dreamer. There are a few ways you can make your blog stand out from the masses.

Forget Index Funds

Index funds are great for your portfolio but dull as dirt to read about. Focus instead on high-risk, high-reward areas like cryptocurrency, cannabis stocks, or biotech. Your readers will either get rich quickly or go broke trying. Either way, you’ll give them an exciting ride.

Lots of Lists

Readers love lists. Give them lots of them. “Top 7 Marijuana Stocks to Buy Now!” “The 5 Most Volatile Cryptocurrencies in 2024!” The actual content doesn’t matter, just make sure each item has a paragraph or two explaining why it’s the next big thing.

Overpromise, Underdeliver

Tell your readers you have the “secrets” and “hacks” to get rich through the stock market. Promise them double-digit returns and early retirement. Will you actually deliver? Probably not, but people love to dream.

And if things go south, you can always blame “market conditions outside your control.” The key is to not take any of this too seriously. An irreverent, tongue-in-cheek style will make your readers chuckle, not cringe.

And if a few end up following your questionable advice? Hey, at least you gave them an interesting story to tell at the next cocktail party. No need to feel guilty—they knew the risks when they signed up!

Read More : 9 High Traffic Low Competition Niches for Blogging in 2024

02. Retirement Planning

So you want to retire someday, eh? Join the club. Unfortunately, if you’re like most people, retirement seems about as feasible as scaling Everest in flip-flops. Between skyrocketing living costs, healthcare bills that could fund a small nation, and the depressing reality that social security probably won’t exist by the time you qualify, planning for retirement can feel utterly futile.

But don’t lose hope just yet! While retirement may be a pipe dream for some, for clever folks like yourself, it’s totally doable—if you start now. The earlier you begin stashing away cash, the less you’ll have to sock away each month.

Even saving a measly $50-$100 per paycheck can add up to hundreds of thousands over time, thanks to the miracle of compound interest. Of course, that’s assuming you pick the right investment vehicles. Skip the savings account earning 0.01% interest and go for higher-yield options like index funds, ETFs, or dividend stocks.

Make your money work for you while you focus on more important things, like perfecting your putting game or building that man cave you’ve always wanted. If your employer offers a matching 401(k) contribution, that’s free money that can supercharge your retirement fund.

At a minimum, contribute enough to get any match offered—that’s an immediate return on your investment. As for IRAs, a Roth IRA allows your money to grow tax-free, while a traditional IRA gives you an upfront tax break. Choose what’s right for your situation.

The bottom line? Retirement may seem implausible, but with discipline, time, and the right plan, you can make it happen. Start now, save as much as you reasonably can, choose solid investment options, take advantage of any matching offers, and keep the dream of margaritas on the beach alive. Your future self will thank you.

03. Wealth Building

If you want to actually build wealth through blogging, you’ve got your work cut out for you, my friend. The finance space is crowded with “gurus” peddling their “foolproof” systems for getting rich quickly. Spoiler alert: there’s no such thing. Building wealth is a slow, steady slog that requires patience, discipline, and the ability to delay gratification.

Save Early and Often

The most valuable wealth-building tool is time. The sooner you start saving and investing, the longer your money has to compound and grow. Even socking away a few bucks a month in your 20s and 30s can make a huge difference down the road.

No need to live like a pauper now in hopes of being a prince later. Find small ways to cut costs so you can put more towards your future freedom fund each month.

Diversify Your Portfolio

Don’t put all your eggs in one basket, as the saying goes. Spread your money across different asset classes like stocks, bonds, real estate, and commodities. That way if one area takes a hit, the others can balance it out. Rebalance regularly to maintain your target allocations. A diversified, long-term approach is the way the big money is made.

Keep an Eye on Fees

Building wealth is challenging enough without greedy middlemen skimming off the top. Look for low-cost investment options like index funds and ETFs. Negotiate lower rates with your financial advisors and money managers.

Every dollar in fees is a dollar less in your pocket. Do your own research instead of blithely handing over your hard-earned cash to so-called “experts.” The path to wealth may not always be exciting or fun. But with patience and persistence, putting one foot in front of the other, you’ll get there.

Stay focused on the long game, keep costs low, and remember that slow and steady wins the race. Before you know it, you’ll be sipping piña coladas on your private island! Well, maybe not, but you’ll be in a much better financial position, and that’s really what matters.

04. Stock Investment

So, you want to dip your toe into the wild world of stock investing, do you? Well, aren’t you an ambitious little scamp? Before you empty your piggy bank and put it all in black, let’s go over the basics.

Know Thyself

First, figure out what kind of investor you are. Do you want to buy and hold for the long run, or are you more of a freewheeling day trader looking for a quick buck? Be honest with yourself here—if volatility gives you hives, stick to mutual funds.

If you’ve got an appetite for risk and a thirst for researching the Next Big Thing, individual stocks could be for you. Just don’t come crying to me when your hot tip turns out to be a flaming bag of dog doo.

Do Your Homework

Alright, so you’ve determined you’re the next Warren Buffett. Now it’s time to analyze some companies. Read the financial reports. Study the products. Follow the industry trends. Get to know management’s strategy and priorities. The more you know, the less likely you’ll be to pick an Enron or a Blockbuster. Unless of course, you’re into that kind of thing.

Diversity Is Key

Once you’ve got a few solid stock picks, it’s time to build your portfolio. But don’t go putting all your eggs in one basket, you naive little scamp! Spread your money across different companies, industries, and stock types. That way if one takes a hit, the others may balance it out. Diversity is the key to long-term success.

Review and Revise

The final step is reviewing and rebalancing. Check-in on your stocks at least quarterly to make sure they’re still performing. Weed out any underperformers and look for new opportunities.

Make changes as needed to match your financial goals. Rinse and repeat, you savvy little investor! Now go forth, and may the odds be ever in your favor! But seriously, good luck. You’re gonna need it.

05. Side Hustles and Passive Income

The Gig Economy Calls

The gig economy is booming these days, so no need to feel trapped in your 9-to-5. Hop on the bandwagon and join the hordes of people making bank from their side hustles. Whether you’ve got a hobby you can monetize or just some free time and wifi, the opportunities abound.

Drive for Dollars

If you own a car and don’t mind strangers in it, consider driving for Uber or Lyft in your spare time. You’ll rake in dough and meet fascinating people along the way. Just be prepared for tales of woe and the odd vomit clean-up. The life of a rideshare driver is not for the faint of heart!

Rent Out Your Pad

Have an extra room or vacant property? Renting it out on Airbnb can generate easy money. You get to set your own rates and availability, and the platform handles the booking and payments.

Before you know it, you’ll have a steady stream of tourists traipsing through your place. If you’re lucky, they’ll even make the bed before they leave. While a side hustle likely won’t replace your full-time job, it can provide extra money for hobbies, travel, or padding your savings account.

And if one of your gigs really takes off, who knows? You may just find yourself with an unexpected new career. The possibilities are endless if you’re willing to take a chance. Now get out there, you budding entrepreneur!

06. Forex Trading

So you want to get into the thrilling world of foreign exchange (forex) trading, do you? Well, aren’t you an ambitious little scamp? Forex trading is essentially gambling but with fancier charts and a lot more zeroes.

The goal is to speculate on the fluctuating values of currencies to try and make an oh-so-sweet profit. If this sounds appealing to you, you’re either an adrenaline junkie, love losing money, or were dropped on your head as a child.

Before you dive in headfirst, you’ll need to pick a forex broker to place your bets with. Do loads of research to find a reputable one, unless you enjoy being swindled. You’ll also need to open a trading account and fund it since you can’t gamble with Monopoly money here.

Start small, maybe a few hundred or thousand dollars, so you can get a feel for the game before going all in. Next, choose a currency pair to trade, like EUR/USD (euros to dollars) or GBP/JPY (British pounds to Japanese yen).

Decide whether you think the value of one currency will rise or fall compared to the other. If you guess right, you make money. Guess wrong, and your money disappears into the ether. Place a “buy” or “sell” order with your broker to enter the market.

Finally, constantly monitor the ups and downs of your currency pair. Look for trends in the market to try and determine the best time to exit your trade with your profits (or losses) intact.

You can set price alerts or stop losses to avoid being caught unawares if the market turns against you. Close out your trade, then rinse and repeat, trying to make more good guesses than bad.

If after all this you still think forex trading sounds fun and not at all stressful, you may just have the right mindset and tolerance for risk to give it a whirl. Just don’t say I didn’t warn you! Now if you’ll excuse me, I have a thrilling game of slots to play.

07. Savings and Emergency Funds

So you’ve started your blog, picked a nifty finance niche, and now the cash is just rolling in, right? Yeah, not so much. Building an audience and monetizing a blog takes time. While visions of dollar signs may be dancing in your head, don’t get too excited just yet. You’ll want to sock away some of that moola in case of emergencies.

Because here’s the deal: Life has a funny way of throwing curveballs when you least expect them. Maybe your trusty laptop decides to up and die, or your car needs a $700 repair. Whatever the case, you’ll want to have an emergency stash of cash on hand so you don’t end up in dire straits.

Most experts recommend saving enough to cover 3 to 6 months of essential expenses, like rent, food, and your internet bill (we know that’s essential for any blogger!). How do you build up this fund? Simple. Set up an automatic transfer to move money from your checking to your savings account each month.

Start with whatever you can, like $25 or $50 bucks, and increase it over time as your income rises. The more you can sock away the better, but don’t deprive yourself of life’s little pleasures in the process.

Find the right balance, ya know? Before you know it, you’ll have built up a tidy little sum to help you sleep at night. Because while blogging can be fun and rewarding, it often takes time to generate meaningful income.

An emergency fund gives you a financial cushion so you can blog without worry, focus on creating great content, and not freak out the next time your site goes down or you face an unexpected expense. After all, the only thing worse than your site crashing is not having the means to fix it, am I right?

Read More : How to Optimize Your Website for Bing in 2024: My Secret

Tips for Creating Unique Content in Your Chosen Niche

So you’ve picked your niche and are ready to start churning out content. But how do you make sure your content isn’t just regurgitated ideas from every other finance blog in the universe? The key is finding your unique angle.

Maybe you’re a rebel accountant with an axe to grind against the establishment. Or perhaps you’re an aspiring online entrepreneur looking to build wealth through side hustles and real estate. Whatever your story, share it with your readers!

Let your personality and experience shine through. People will connect more with authentic content that feels genuinely helpful rather than manufactured. Another tip is to go broad and dig deep. Cover the evergreen topics that people are always searching for, like “how to save money on groceries” or “pros and cons of Roth IRAs.”

But don’t just skim the surface. Do extensive research from multiple sources. Interview experts. Share data, statistics, and examples that go beyond generic advice. Provide actionable tips readers can implement right away.

You should also consider repurposing and repackaging existing content in new ways. Turn a blog post into an infographic or video. Compile older posts into an ebook. Podcast about a topic you’ve written on.

These remixes give you more opportunities to rank in search and promote your content. They also provide value to readers who prefer consuming information in different formats. In the end, the key to unique content is thinking outside the box. Question assumptions. Challenge conventional wisdom.

Dare to share a contrarian perspective. Readers will flock to a finance blog that intrigues them with fresh ideas and new ways of looking at familiar subjects. So unleash your creativity and don’t be afraid to color outside the lines! Your niche will thank you for it.

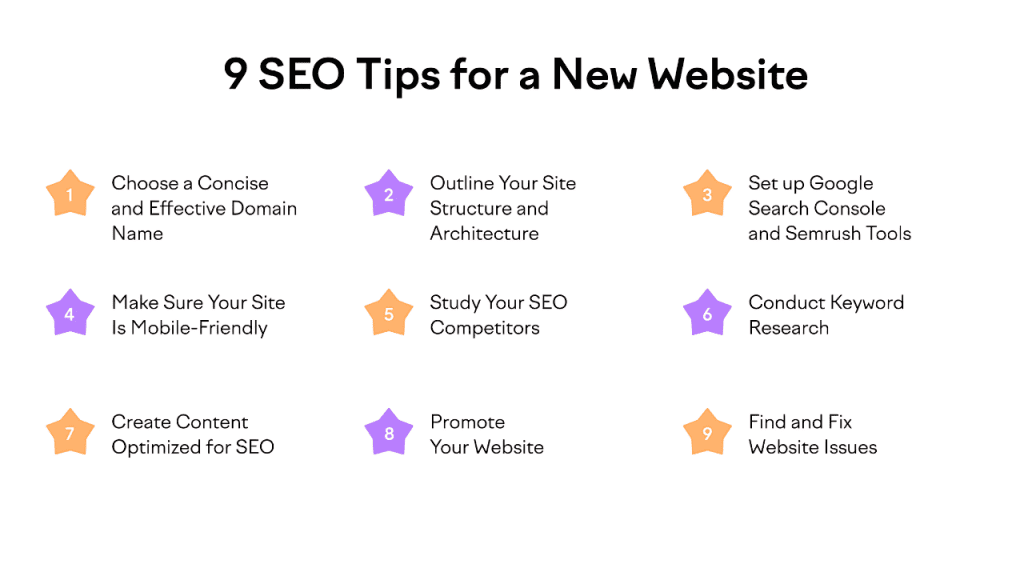

Optimizing Your Blog for SEO Success in a Competitive Niche

So you want to start a finance blog, do you? Look at you, thinking you’re the next Suze Orman. That’s adorable. Before you start dispensing financial wisdom to the unwashed masses, you’ve got to figure out how to get anyone to actually read your little blog in the first place.

And in a niche as crowded as finance, that means optimizing the heck out of your content for search engines. SEO may not be the sexiest part of blogging, but without it, you’ll just be shouting into the void.

Do you really want to spend hours crafting Pulitzer-worthy prose if the only people reading it are your parents? Didn’t think so. To give your finance blog a fighting chance, you need to do the following:

Focus on your content. Don’t try to cover every finance topic under the sun. Pick a few micro-niches, like retirement planning or paying off student loans, and stick to them. Establish yourself as an expert in those areas.

Optimize your page titles, page URLs, and header tags by including important keywords related to your topics. But don’t go overboard, as that looks spammy to both search engines and readers.

Write awesome content. Yes, even with perfect SEO, content is still king. Create detailed, helpful posts that actually provide value to readers. Aim for at least 500 words per post. Build internal links between your content to keep people on your site longer.

But don’t link just for the sake of linking. Only link when it’s genuinely helpful for the reader. Promote your content on social media to build backlinks and drive traffic. But don’t just blast out links. Engage with your followers. Provide useful tidbits and start discussions.

Keep at it and stay patient. Building authority and ranking in search engines takes time. But if you publish amazing, optimized content regularly, the traffic will come. Eventually. So get to work, you finance wannabe. The world is waiting to be enlightened by your financial genius—they just don’t know it yet!

Promoting Your Finance Blog Through Social Media

Let’s be honest, social media is both the bane of our existence and the fuel that keeps the digital world churning. As a finance blogger, social media is your new BFF whether you like it or not. While hashtags, likes, and shares may seem frivolous, they’re essential for spreading your financial wisdom to the masses.

So saddle up to the social media rodeo and pick your poison. Are you a Facebook fanatic, a Twitter maven, or an Instagram influencer-in-the-making? Whatever your platform of choice, make it your mission to build an audience.

Post regularly, engage with followers, and don’t be afraid to show some personality. People want authenticity, not automated advice bots. Once you’ve built up your social posse, it’s time to turn them into blog traffic and subscribers.

Tease your latest posts, share key tips, and invite people to read more on your blog. A little self-promotion never hurts anyone, especially if you’re providing value. Speaking of value, focus less on selling and more on educating. Build trust and your audience will reward you.

Of course, social media is a two-way street. Don’t just broadcast your posts into the void. Engage with your readers by replying to their comments, messages, and tweets. Ask for feedback and opinions. Run contests and giveaways. Make social connections and they’ll turn into loyal readers.

While social media may seem like a necessary evil, use it for good. Spread your financial insights, build real relationships, drive traffic to your blog, and ultimately, help your readers achieve more financial freedom. The social media rodeo may be a wild ride, but with the right approach, you’ll be wrangling in new readers and riding off into the sunset. Now giddy up!

Monetizing Your Blog Through Affiliate Marketing and Sponsored Posts

So you’ve started a finance blog and gained some traction. The time has come to rake in the big bucks, right? Not so fast, moneybags. Before you can start swimming in a pool of gold coins like Scrooge McDuck, you need to actually make some money. How do the big dogs of finance blogging line their pockets?

Two tried-and-true methods: affiliate marketing and sponsored posts. Affiliate marketing is when you promote other companies’ products and services on your blog and get a commission for any sales or signups. All you have to do is paste some links or banners on your site, and cha-ching! Money rolls in while you sleep.

Okay, it’s not quite that easy, but with an engaged audience, affiliate marketing can be a set-it-and-forget-it form of income. The trick is finding products and services that genuinely provide value to your readers so you don’t come off as a sleazy salesperson. Unless a sleazy salesperson is the vibe you’re going for. No judgment.

For sponsored posts, companies pay you to feature their product or service on your blog. You get money upfront to write about how awesome they are. Sweet deal, right? Sure, if you don’t mind compromising your editorial integrity for cold hard cash.

Not all sponsored posts are evil—some companies may give you full creative control. But be transparent with your readers and avoid overtly promotional content, or you’ll lose their trust faster than you can spend those sponsor dollars.

If done right, affiliate marketing and sponsored posts can help turn your finance blog into a money-making machine. But keep your content authentic, be upfront with your audience, and don’t sell out for short-term gains. Your readers and your reputation will thank you. And the money will follow.

Conclusion

So there you have it, folks. The top micro-niches in finance blogging for 2024. I know you’re just itching to dive in and start churning out content on couponing side hustles or whatever niche tickles your fancy. But don’t forget – with great niche power comes great responsibility.

Do your homework, find your unique voice, and provide value to your readers. If you do that, you’ll be well on your way to building a thriving blogging business before you know it. The finance world is your oyster – now go get that pearl!

Read More : 7 Work From Home Jobs No Experience and Immediate Start

Oko Dot All In One Technology Solutions By Likhon Hussain

Oko Dot All In One Technology Solutions By Likhon Hussain